One of the first products of a joint venture between one of the world’s most tech-industry leading, mobile app development company’s (Apple) and the highly lucrative financial distribution across the world is now soon-to-be in the hands of consumers. The rollout of the highly-anticipated ‘Apple Card’ created a lot of buzz online only a few months after a short, but sweet launch announcement from Apple themselves. This comes as no surprise as usually everything and anything Apple does is seen as larger than life, which includes not only their announcements but their revolutionary mobile app development software and unique products. The main question that the announcement has left in people’s minds is: Will they be a success?

For those who may be unaware, the Apple Card is a credit card mobile application account specifically for Apple Pay mobile users. Primarily, the account is digital, and Apple is also offering a physical credit card as a direct companion to the account. The ultimate goal of this ambitious launch is to try and attract more people to use Apple Pay as their dedicated mobile banking app.

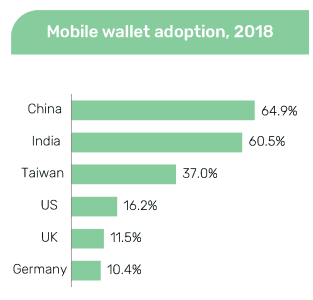

According to GlobalData’s Mobile Wallet Analytics, only 16.2% of US citizens have successfully adopted the trend of a mobile application wallet in 2018. This doesn’t quite equate to the 64.9% of people in China that have embraced the mobile financial technology, and it would come as no surprise that Apple is unlikely to “rethink/revolutionise” the credit card industry with this particular launch. However, what is appreciated is their ambitions to expand their target audience and industry spread.

Inevitably, Apple is well-known for being a technology leader. However, they have yet to fully utilise the aspects of credit card features that we all appreciate and love for its convenience as the physical Apple Credit Card is not contactless. Instead, the company is advising people to make payments using their iPhones via Apple Pay. By heavily focusing on this method as the best payment option for consumers, Apple undoubtedly limits their reach, which will contiune to result in the services of the physical tech-card being unique but not very compelling with its limited features that it has to offer.

The Selling-Points of the Financial Venture

The Apple Card’s main selling point is its mobile app design and the unique design of the physical card. Maintaining its sleek and minimalistic appeal (very on-brand with Apple) the physical card doesn’t include a long digit card number, CVV code, expiration date or a signature, which helps in the fight against credit card fraud and privacy protection. It’s safe to say that the Apple Card isn’t the only tech-card to have a minimalistic appeal, as there’s parallels with Venmo’s Card and Chase Sapphire Reserve’s Card. In spite of this, Apple is hoping to entice the market further by providing spending summaries and budgeting suggestions based on a user’s spending habits with Apple Pay. The Apple Card also offers consumers various cashback rewards, which can be used towards a series of Apple-specific products (MacBook and iPhones) as a clear bid to push the sales of the brand’s own content. Meanwhile, purchases made at other stores will benefit from 2% cashback using Apple Pay.

How Will The Apple Card Be Different?

Despite its lack of unique and innovative features, the Apple Card aims to differentiate itself within the tech-card industry by promising to keep user’s credit card transaction data private, and their financial information secure, which ever so more important in today’s climate of data protection. More specifically, Apple vows to not be monitoring user’s spending habits and they will not share or sell their data for marketing advertising purposes.

Although the Apple Card is a fresh creation on Apple’s behalf, whether it will be successful and have an impact on the tech-card industry is a tough call to make. The Apple Card isn’t necessarily unique in terms of the rewards scheme offered, design or features. Whilst Apple’s commitment to data privacy and protection may appeal to those who are genuinely concerned about this issue, the Apple Card will likely not have the collusal impact, or revolutionise the mobile financial banking app industry as Apple has essentially launched a standard product with a few cool gimmicks for true Apple enthusiasts.

If you have an app idea, Talk To Us today!

Share this

Subscribe To Our Blog

You May Also Like

These Related Stories

The Story Behind the Success of the World’s Industry Leading Experts: Apple

Look Back at 10 of the Best Apps From This Year’s World Cup