Should My Farming App Include Financial Management And Budgeting Features?

Nearly 40% of farm businesses fail within their first five years, and poor financial management is the leading cause. I've been building apps for agricultural clients for years now, and I can tell you that farmers are brilliant at growing crops and raising livestock—but when it comes to tracking expenses, managing cash flow, or planning budgets? That's where things get tricky.

The question isn't really whether your farming app should include financial management features. It's whether you can afford not to include them. Modern farms operate on razor-thin margins; a single poor financial decision can wipe out months of hard work. Yet most farmers are still using spreadsheets, paper receipts, or—worse yet—keeping everything in their heads.

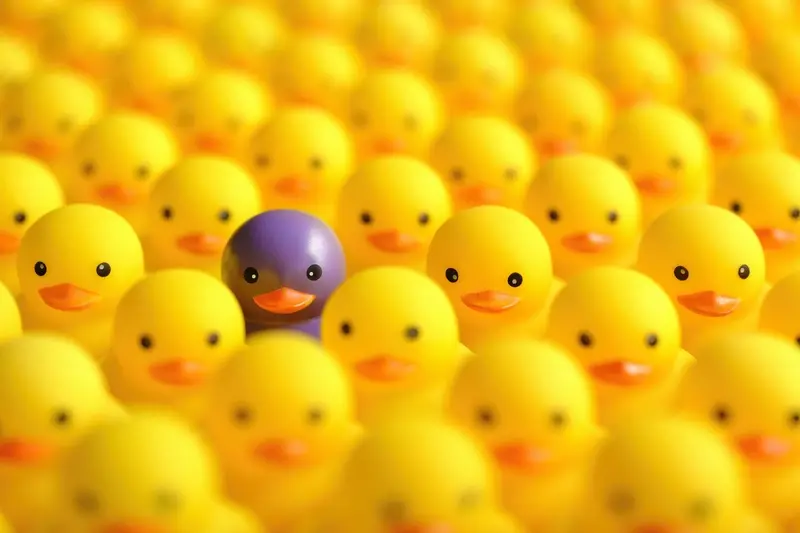

The most successful farming apps don't just help farmers grow better crops; they help farmers grow better businesses

That's where your app comes in. By integrating financial management and budgeting features, you're not just creating another farming tool—you're building a comprehensive business platform. Farm budgeting software can track everything from seed costs to fuel expenses, whilst agricultural economics data helps farmers make informed decisions about crop selection and market timing. The real magic happens when these financial tools work seamlessly with your app's other features, creating a unified experience that farmers actually want to use.

Understanding Financial Management in Farming Apps

I'll be honest with you—when I first started working on farming apps years ago, I didn't really understand why financial management was such a big deal. After all, weren't these apps supposed to be about tracking crops and weather patterns? But then I spoke to actual farmers, and everything clicked into place.

Financial management in farming isn't just about keeping receipts in a shoebox anymore. Modern farmers need to track dozens of different costs, from seed purchases to fuel expenses, whilst also monitoring income from various crops or livestock. They're running proper businesses, often worth hundreds of thousands of pounds, and they need tools that reflect that reality.

What Makes Farm Financial Management Different

Farm finances work differently from other businesses. Income arrives in big chunks at harvest time, but expenses happen all year round. There's also the unpredictable nature of farming—a bad weather season can completely throw off your budget projections.

- Seasonal cash flow patterns that don't match typical business models

- Multiple revenue streams from different crops or livestock

- Variable costs that depend on weather and market conditions

- Long-term investments in equipment and land improvements

- Government subsidies and grants that need careful tracking

The farmers I've worked with tell me they spend hours each week just trying to work out if they're making money or losing it. That's time they'd rather spend actually farming—and that's where good app design can make a real difference.

The Role of Farm Budgeting in Modern Agriculture

Farm budgeting has become the backbone of successful agricultural operations—and I mean that quite literally. Without proper budgeting, farmers are flying blind when it comes to making decisions that could make or break their entire season. The days of relying on gut feelings and rough estimates are long gone.

Modern farming requires precision in every aspect, from seed selection to harvest timing. Financial planning sits at the heart of this precision. Farmers need to know exactly how much they're spending on inputs like fertilisers, pesticides, and machinery maintenance before they even plant their first crop. This forward-thinking approach helps them avoid the nasty surprises that can destroy profit margins.

Why Digital Farm Budgeting Matters

Traditional paper-based budgeting methods simply can't keep up with today's farming complexities. Weather patterns change rapidly, commodity prices fluctuate daily, and input costs vary between suppliers. Digital budgeting tools help farmers track these variables in real-time.

Start with basic income and expense tracking before adding complex forecasting features—farmers need to trust the basics before embracing advanced functionality.

Key Benefits for Agricultural Operations

- Real-time expense tracking across multiple crops or livestock

- Seasonal cash flow planning for better financial stability

- Profit margin analysis by field or farming operation

- Equipment depreciation calculations for tax planning

- Input cost comparisons between different suppliers

The integration of farm budgeting into mobile applications makes financial management accessible right from the field. Farmers can update expenses immediately rather than trying to remember costs weeks later—trust me, memory isn't reliable when you're dealing with hundreds of transactions per season.

Agricultural Economics and Digital Solutions

I've worked with farming clients for years now, and there's one thing that keeps coming up—farmers are brilliant at growing things but often struggle with the business side. The economics of farming have become incredibly complex; commodity prices fluctuate wildly, input costs keep rising, and profit margins are getting tighter each year.

Digital solutions are changing how farmers approach their finances. Instead of relying on spreadsheets or paper records, smart farming apps can track everything from seed costs to harvest revenues in real-time. This isn't just about convenience—it's about survival in an increasingly competitive industry.

Key Economic Challenges Facing Modern Farmers

- Unpredictable weather affecting crop yields and income

- Rising costs for fuel, fertiliser, and equipment

- Complex government subsidy schemes and compliance requirements

- Market volatility making it difficult to plan ahead

- Cash flow gaps between planting and harvest seasons

The beauty of integrating economic tools into farming apps lies in the data connection. When your app already tracks planting schedules, weather patterns, and crop health, adding financial management becomes incredibly powerful. Farmers can see exactly which fields are most profitable, when to sell their produce for maximum return, and how to budget for the next growing season.

This integration transforms farming from guesswork into data-driven decision making—something that's becoming essential for long-term success.

Core Features for Financial Management

Right, let's get down to the nitty-gritty—what features should your farming app actually have if you want to help farmers manage their money properly? After years of building apps across different industries, I've learnt that the best financial tools are the ones that don't feel like homework.

Income and Expense Tracking

The backbone of any farm budgeting system is simple tracking. Farmers need to log what money comes in (crop sales, livestock sales, subsidies) and what goes out (seeds, feed, fuel, equipment repairs). But here's the thing—it needs to be quick. Nobody wants to spend twenty minutes entering data after a long day in the fields.

Seasonal Budget Planning

Farming isn't like running a shop where money flows steadily throughout the year. Agricultural economics work in cycles—big expenses in spring, income concentrated around harvest time. Your app needs to understand this rhythm and help farmers plan accordingly.

The most successful farming apps are the ones that fit into a farmer's existing workflow, not the ones that force them to change everything they do

Cash flow forecasting becomes absolutely critical here. Farmers need to see months ahead—will they have enough money to cover winter costs? Can they afford that new tractor in March? These aren't nice-to-have features; they're business survival tools that can make or break a farming operation.

Implementation Challenges and Technical Considerations

Building financial management features into farming apps isn't a walk in the park—there are quite a few technical hurdles you'll need to jump over. The biggest challenge? Data security. You're dealing with sensitive financial information, business records, and personal details that farmers absolutely cannot afford to lose or have stolen.

Your app needs rock-solid encryption, secure data storage, and proper user authentication systems. This means working with experienced developers who understand financial data protection standards; you can't just wing it with basic security measures.

Integration Complexity

Another major headache is connecting your app to existing farm management systems and accounting software. Farmers often use multiple tools—spreadsheets, desktop accounting programmes, machinery monitoring systems—and they'll expect your app to play nicely with what they already have.

Building these integrations takes time and expertise. You'll need APIs that can handle different data formats, sync information reliably, and deal with offline scenarios when farmers are working in areas with poor internet coverage.

Real-Time Data Processing

Financial calculations need to be accurate and fast. When a farmer enters crop yields or equipment costs, your app should instantly update budgets, profit projections, and cash flow forecasts. This requires robust backend systems that can handle complex calculations without slowing down or crashing—something that's easier said than done when dealing with large amounts of agricultural data.

User Experience and Interface Design for Financial Tools

When it comes to financial management features in farming apps, the interface design can make or break the entire experience. I've seen countless apps with brilliant financial tools that farmers simply won't use because they're too complicated or intimidating. The trick is making complex agricultural economics feel simple and approachable.

Your financial interface needs to speak the farmer's language—not the accountant's. This means using terms like "feed costs" instead of "operational expenditure" and showing profit margins in pounds per acre rather than percentage calculations. The moment a farmer opens your budgeting section, they should immediately understand what they're looking at without needing a manual.

Essential Design Principles

Visual hierarchy matters enormously in farm budgeting interfaces. Farmers need to spot problems quickly—a sudden spike in fertiliser costs or a drop in milk prices shouldn't be buried in a spreadsheet. Use colour coding wisely: red for losses, green for profits, and amber for areas needing attention.

- Keep input forms short and relevant to farming seasons

- Use large, finger-friendly buttons for outdoor use

- Display key financial metrics prominently on the dashboard

- Include quick-entry options for common expenses

- Provide clear visual summaries of budget vs actual spending

Always test your financial tools with actual farmers, not just designers or developers. Their feedback will reveal usability issues you'd never spot otherwise.

The best financial interfaces feel like having a conversation with a trusted farm advisor rather than wrestling with accounting software. Keep this principle at the heart of every design decision.

Conclusion

After building dozens of farming apps over the years, I can tell you that financial management features aren't just nice-to-have additions—they're becoming expected by users. Farmers are running businesses, and businesses need proper financial tools to survive and grow.

The evidence is clear: farmers who track their finances digitally make better decisions, spot problems earlier, and usually see improved profits. Your app doesn't need every financial feature under the sun, but it should cover the basics well. Budget tracking, expense monitoring, and simple profit calculations will serve most users brilliantly.

The technical challenges we've discussed are real, but they're not insurmountable. Start small with core features and build from there. Your users will appreciate a simple, reliable budgeting tool over a complex system that crashes or confuses them. I've seen too many apps fail because they tried to do everything at once.

The farming industry is changing rapidly, and technology adoption is accelerating. Apps that help farmers manage both their operations and their money will have a significant advantage over those that don't. Your farming app should absolutely include financial management features—just make sure you implement them thoughtfully and with your users' real needs in mind.

Share this

Subscribe To Our Learning Centre

You May Also Like

These Related Guides

What's The Difference Between Consumer And Enterprise App Development?

What Are the Essential Features Every Startup App Needs?