You know that sinking feeling when you're using your favourite app and suddenly everything stops working? The payment won't go through, your photos won't upload, or worse—you can't log in at all. Well, I've got some news for you: nine times out of ten, it's not the app itself that's broken. It's something called an API integration that's gone completely wrong.

I've been building mobile apps for years now, and API failures are honestly one of the most common development mistakes I see. They're also some of the most preventable. The thing is, when APIs break, they don't just inconvenience users—they can destroy businesses overnight. I've watched companies lose millions in revenue because their payment API went down during Black Friday. I've seen startups fold because a security breach exposed their users' personal data through a poorly integrated third-party service.

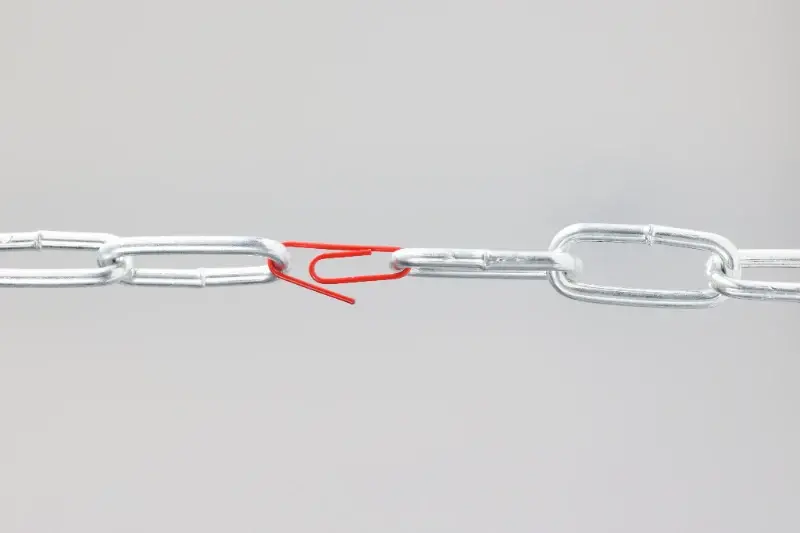

The scariest part about API failures isn't that they happen—it's that most developers never see them coming until it's too late

But here's what really gets me: most of these disasters could have been avoided with proper planning and testing. The stories I'm about to share aren't just cautionary tales—they're real examples of what happens when API integration goes wrong, and more importantly, how you can stop it happening to your app.

The Social Media Meltdown That Crashed Christmas Shopping

A major retail app learned this lesson the hard way during their busiest shopping season. They had integrated with multiple social media APIs to let customers share their purchases and log in using their Facebook or Instagram accounts. Sounds straightforward, right? Well, not quite.

The trouble started when Facebook changed their API without proper warning—something that happens more often than you'd think. The app's authentication system broke completely, which meant customers couldn't log in to their accounts. But here's where it gets worse: the error handling was so poor that when the social login failed, it crashed the entire checkout process.

Thousands of customers lost their shopping carts mid-purchase. The app kept freezing, payments wouldn't process, and customer service was flooded with angry calls. Sales dropped by 60% during what should have been their biggest week of the year.

What Went Wrong

The development team had made a classic mistake—they built their core functionality around a third-party service without any backup plan. When the social media API failed, there was no fallback system to keep the app running. They also didn't implement proper error handling, so instead of gracefully managing the failure, the whole system came crashing down.

When Payment Processing Goes Horribly Wrong

Payment processing APIs can turn into absolute nightmares faster than you can say "declined transaction." I've seen apps where users' payments went through multiple times, charging them repeatedly for the same purchase. One retail app we worked on had integrated with a payment gateway that didn't properly handle network timeouts—customers would tap "buy" once, nothing would happen, so they'd tap again, and again. The API was actually processing every single request, just taking ages to respond.

The worst part? The app showed "payment failed" messages whilst the bank was busy charging customers three or four times. Customer service was flooded with angry complaints, and the app's rating plummeted overnight. The company had to process thousands of refunds manually.

Another client integrated with a payment processor that changed their API response format without warning. Suddenly, successful payments were being marked as failed in the app, even though money was leaving customers' accounts. Users couldn't access their purchases, support tickets piled up, and trust in the brand completely disappeared.

Always implement proper error handling and timeout management for payment APIs. Test failure scenarios extensively, and never rely on just one response field to determine payment success.

Common Payment API Mistakes

- Not handling network timeouts properly

- Failing to implement idempotency keys

- Ignoring webhook notifications from payment providers

- Not testing refund and cancellation flows

- Relying on client-side validation only

If you're looking to implement payment processing correctly, understanding how to integrate payment APIs like Stripe from the start can save you from these nightmare scenarios.

The Database Disaster That Leaked Personal Information

One of our clients came to us after their previous development team had built what looked like a perfectly functional fitness app. Everything seemed fine during testing—users could log workouts, track progress, and share achievements with friends. The app had been live for three months when they discovered something terrifying: every single piece of personal data was being stored in plain text and transmitted without encryption.

The API integration they'd built was sending usernames, email addresses, workout locations, and even some health data back and forth like postcards—completely readable by anyone who knew where to look. When a security researcher found the vulnerability and reported it, the company faced a nightmare scenario. They had to contact over 50,000 users to inform them of the breach.

What Went Wrong

The development team had focused so much on making the app work that they'd completely ignored basic security principles. They weren't encrypting data at rest or in transit, and they hadn't implemented proper authentication tokens.

- No SSL certificates for secure data transmission

- Database stored passwords and personal information in plain text

- API endpoints were accessible without proper authentication

- No data validation or sanitisation on user inputs

- Missing security headers and CORS policies

The company ended up spending more money on legal fees and security audits than they'd originally budgeted for the entire app development. We rebuilt their backend from scratch with proper encryption and security protocols—something that should have been done from day one.

Authentication Nightmares and User Data Breaches

Authentication systems can be tricky beasts—especially when they're connected to third-party APIs. I've seen too many apps that looked rock solid on the surface but had gaping security holes underneath. One particular case still makes me wince: a fitness app that stored user passwords in plain text whilst claiming to use "military-grade encryption" in their marketing materials.

The real trouble started when their OAuth integration with a popular social media platform began accepting expired tokens. Users could log in with credentials that should have been invalid, and worse still, the app wasn't properly validating user permissions on the backend. This meant people were accessing other users' workout data, personal messages, and even payment information.

We thought our authentication was bulletproof until we discovered users were seeing each other's private health data. The panic was immediate and the damage to our reputation was devastating.

The fix required a complete overhaul of their authentication flow, proper token validation, and implementing rate limiting to prevent brute force attacks. They also had to notify thousands of users about the breach and offer free credit monitoring services. The whole mess could have been avoided with proper API security testing and regular security audits—something we now build into every project from day one.

The Third-Party Service That Disappeared Overnight

One of our clients built a fitness app that relied on a third-party weather service to suggest outdoor workouts based on local conditions. The service had been running smoothly for months—until one Tuesday morning when it simply vanished. No warning, no migration notice, just a 404 error where their API used to be.

The company behind the weather service had been acquired by a larger tech firm who decided to shut down the public API immediately. Our client's app suddenly couldn't tell users whether it was sunny enough for a run or too rainy for cycling. Users started leaving negative reviews, and the app's core functionality was broken.

Common Reasons Third-Party Services Disappear

- Company acquisitions where new owners shut down services

- Financial troubles leading to sudden closures

- Policy changes that restrict API access

- Services pivoting to different business models

- Technical failures with no backup systems

We rebuilt the app using multiple weather data sources with automatic failover. When the primary service goes down, the app switches to a backup provider within seconds. The lesson? Never put all your eggs in one basket—especially when that basket belongs to someone else. Always have a Plan B ready, because third-party services can disappear faster than you'd think.

When negative reviews started pouring in, they quickly learned the importance of handling social media criticism effectively while fixing the underlying problems.

Testing Your API Integrations Before Launch

After hearing all these horror stories, you're probably thinking the same thing I am—most of these API failures could have been caught before launch. That's the frustrating part about development mistakes; they're often preventable with proper testing.

The key is testing your API integrations in different scenarios, not just the happy path where everything works perfectly. What happens when the payment processor is down for maintenance? How does your app behave when the weather API returns incomplete data? These edge cases are where problems hide.

This is exactly why proper planning and testing are crucial for development project success—rushing to launch without thorough API testing is a recipe for disaster.

Load Testing Under Pressure

I always tell my team to test APIs under heavy load—simulate Black Friday traffic, not a quiet Tuesday afternoon. Many integrations work fine with a few users but crumble when hundreds hit them simultaneously. Use tools that can generate realistic traffic patterns and watch for bottlenecks.

Monitor Response Times and Error Rates

Set up monitoring that tracks API response times and error rates during testing. If your payment integration takes 30 seconds to respond, users will abandon their purchases. If authentication fails 10% of the time, you'll lose customers fast.

Create a testing checklist that includes timeout scenarios, network failures, and invalid responses. Test what happens when APIs return unexpected data formats or when third-party services go offline completely.

Remember, thorough testing isn't glamorous work, but it's what separates professional developers from those who learn about API failures through angry user reviews.

Building Safe API Connections That Last

After seeing all those horror stories, you're probably wondering how to avoid ending up in the same mess. The good news is that building rock-solid API connections isn't rocket science—it just takes some careful planning and the right approach from day one.

I've learned over the years that the most reliable integrations are built with failure in mind. Sounds backwards, doesn't it? But when you assume things will go wrong, you build systems that can handle problems gracefully. Rate limiting, proper error handling, and fallback mechanisms aren't just nice-to-haves—they're your lifeline when things get messy.

Working with an experienced development team means understanding what your app developers need from you to build these robust integrations properly from the start.

Your API Safety Checklist

- Always use HTTPS and proper authentication tokens

- Set up monitoring and alerts for all API endpoints

- Build retry logic with exponential backoff

- Store API keys securely, never in your source code

- Have backup plans for when services go down

- Test your integrations regularly, not just at launch

The secret sauce? Documentation and communication with your API providers. Know their maintenance schedules, understand their rate limits, and always have a direct contact for when things go sideways. Trust me, that relationship will save you more headaches than any fancy monitoring tool ever will.

When APIs do fail and impact customer experience, having a solid plan for how your app can improve customer service during the recovery process can help maintain user trust.

These lessons align with what makes the difference between mediocre apps and stellar ones—attention to detail, proper testing, and building with failure scenarios in mind.

For businesses looking to connect their apps with existing systems, understanding how app integration works with business systems can help avoid many of these pitfalls from the planning stage.

Conclusion

After seeing these horror stories, you might think API integration is too risky to bother with. But that's not the case at all! Every mobile app we build at Glance relies on APIs—they're what make modern apps so powerful and useful. The key is learning from these mistakes rather than repeating them.

The common thread running through all these disasters? They were preventable. Poor testing, weak security, lack of backup plans, and rushed development timelines caused every single one of these problems. When you take shortcuts with API integration, you're not just risking a few bugs—you're potentially putting your entire business at risk.

I've seen developers bounce back from API failures by implementing proper testing procedures, building robust error handling, and creating backup systems. The apps that succeed long-term are the ones that treat API integration as a critical part of their architecture, not an afterthought.

Your users trust you with their data and their time. When APIs break, that trust breaks too. But when you build them properly—with security, testing, and monitoring built in from day one—APIs become your app's superpower rather than its weakness.

Share this

Subscribe To Our Blog

You May Also Like

These Related Stories

OWASP API Security Risks Every Mobile Developer Must Know

API Security Vulnerabilities That Break Mobile Platforms